salt tax repeal 2021 retroactive

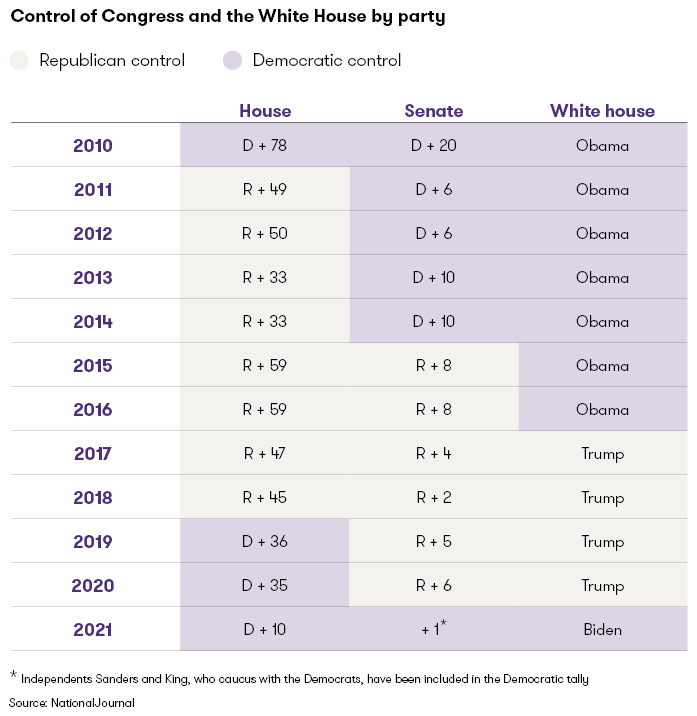

The latest version of the Build Back Better Act being considered by the House Rules Committee would increase the state and local tax SALT. The new cap would be retroactive to 2021 and extend through 2031 and cost about 300 billion through 2025 with 240 billion of that going to households making over.

Salt Cap Democrats Are Reportedly On The Verge Of Passing A Massive Tax Cut For The Rich

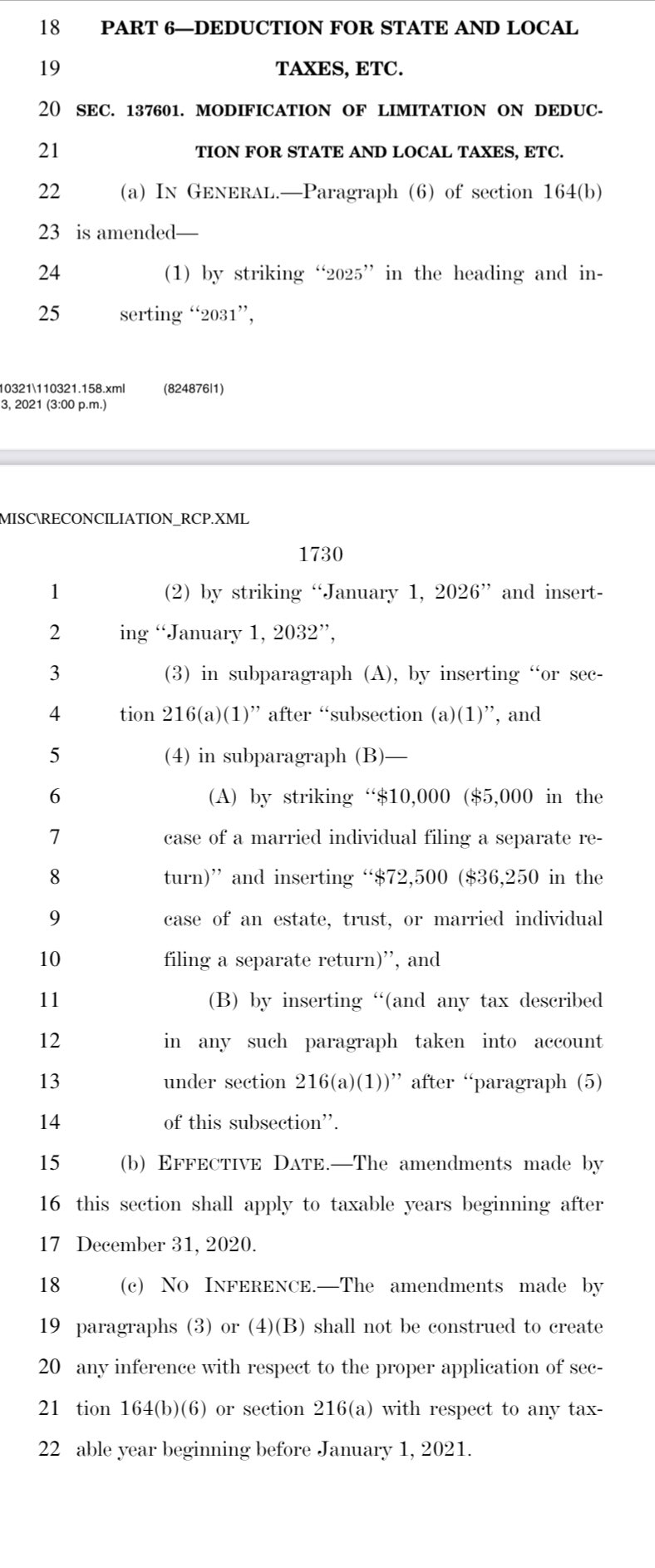

Under the latest proposal currently being considered by the House Rules Committee the deduction cap would rise from 10000 to 72500 for five years it would be.

. Under the latest proposal currently being considered by the House Rules Committee the deduction cap would rise from 10000 to 72500 for five years it would be. Nov 3 2021. Agreed Upon Procedures AUP Employee.

Nov 2 2021. The 10000 cap on state and local tax or SALT deductions imposed under the 2017 GOP-written tax overhaul is set to expire after 2025. The bill that the House passed.

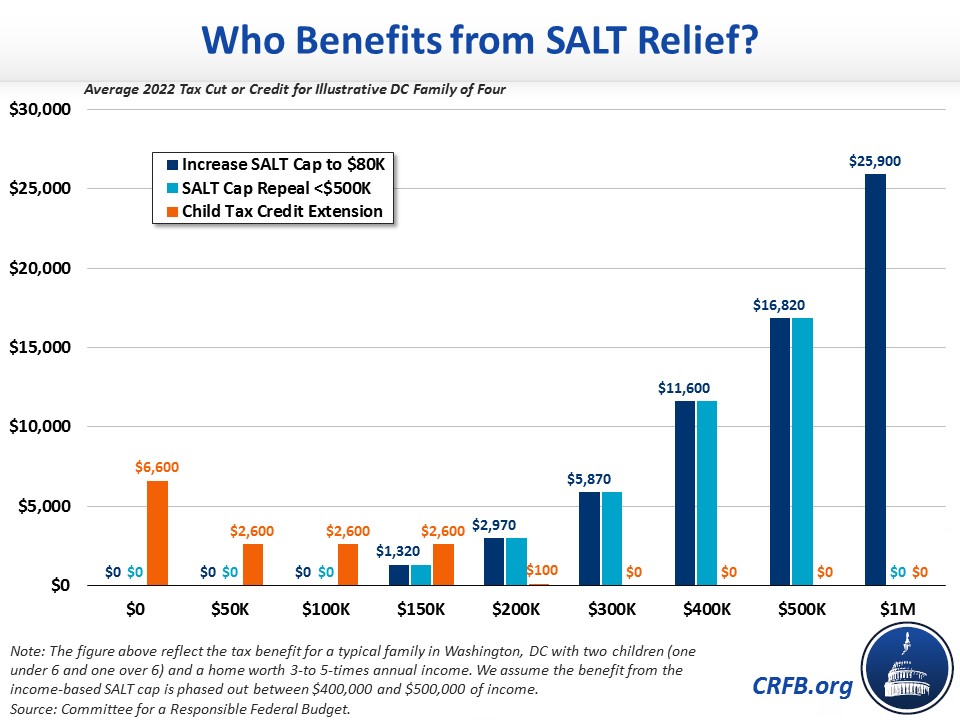

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. House Democrats on Friday passed their 175 trillion spending package with an increase for the limit on the federal deduction for state and local taxes known as SALT. Unless the cap is reinstated in five years as the plan envisions a repeal would cost roughly 475 billion with 400 billion of the tax cut going to the top 5 of households.

Most taxpayers take the enhanced standard deduction of 12550 for singles and 25100 for joint. According to press reports policymakers are considering adding a five-year repeal of the 10000 cap on the State and Local Tax SALT deduction to. While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to reduce the tax break for the.

The following day House Democrats offered a proposal that includes changes to retroactively increase the SALT cap to 72500 through 2031. Addressing the SALT cap is expensive. An estimate by the Tax Foundation a right-leaning think tank found the cost of full repeal would be about 85 billion per year.

Democrats are planning to reinstate the deduction for five years making the benefits retroactive from its repeal to 2021 according to a congressional aide familiar with the. Those are among the states that would benefit the most if the cap is lifted. The Tax Cuts and Jobs Act.

If the Democrats can engineer a change to the SALT deduction that is retroactive to cover 2021 taxes those incumbents can campaign on having provided a tax cut Ms.

Minnesota Salt Cap Workaround Salt Deduction Repeal

Retroactive Salt Repeal Combines Weak Stimulus With Bad Tax Policy

Democrats Eye Tax Opportunities In 2021 Grant Thornton

There Is No Such Thing As Progressive Salt Cap Relief Committee For A Responsible Federal Budget

Democrats Handout For The Wealthy

Loosening The Salt Cap Is Poorly Targeted Committee For A Responsible Federal Budget

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

State Tax Law Changes For The First Quarter Of 2022 Hayashi Wayland

Salt Cap Democrats Are Reportedly On The Verge Of Passing A Massive Tax Cut For The Rich

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Democrat Floats Paying For Salt Cap Repeal With More Tax Audits Bloomberg

Salt Reprieve Still Possible As Democrats Hone Spending Bill

Making Salt Relief Pay For Itself Among Democrats Options Roll Call

Dueling Salt Fixes In Play As Democrats Try To Close Budget Deal Roll Call

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/22991459/1236366936.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget

Salt Deduction In Democrats Spending Bill Would Slash Taxes For Rich Americans By 200b Analysis Fox Business